Guide to insurance industry CRM: Everything you need to know

In the world of insurance, staying organised, responsive, and customer-focused is key to long-term success. At enable.services, we’ve helped countless insurance providers streamline their operations and build stronger client relationships through smart CRM strategies.

It’s crucial for insurance companies to build a secure and results-driven digital strategy that allows real-time updates, rapid deployment, and seamless integration. But when it comes to CRM systems? Which solutions does your insurance firm need, and why do you need one?

This guide is designed to walk you through everything you need to know about insurance CRM solutions – what they are, why they matter, and how to choose the best CRM for insurance agents. Whether you’re just starting out or looking to upgrade your existing system, we’re here to help you get it right.

What is a CRM for insurance?

An insurance CRM system help agents and brokers manage their interactions with current and prospective clients.

The goal of a CRM in insurance is simple: deliver better service, drive sales, and reduce time spent on administrative tasks.

Why you need an insurance CRM

1. Centralised data

Instead of juggling spreadsheets, email threads, and scattered documents, an insurance CRM puts everything in one place. You can instantly access client information, policy history, communication logs, and more, all from a single dashboard.

2. Lead and sales management

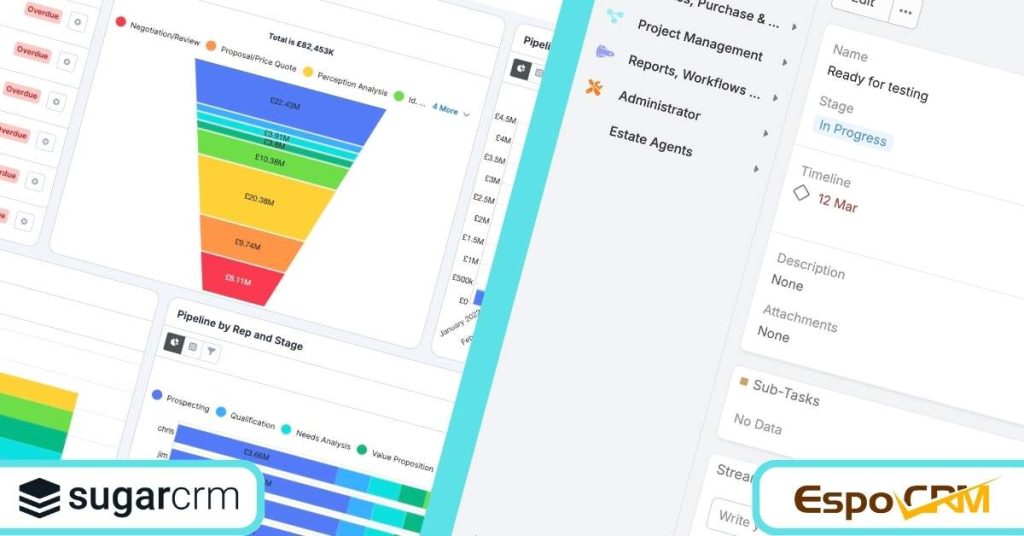

Modern insurance CRM solutions like SugarCRM are built to help you identify, track, and convert leads. Many offer automated workflows and AI-driven insights to help agents prioritise high-potential prospects and follow up efficiently.

3. Improved customer service

With detailed client histories at your fingertips, you can offer more personalised and timely support. Automated reminders also ensure you never miss a renewal or birthday greeting, strengthening client loyalty.

4. Regulatory compliance

CRMs help you maintain detailed logs of communications and actions, aiding compliance with industry regulations and reducing the risk of fines or audits.

5. Efficiency and automation

Tasks like sending policy renewal notices, scheduling follow-ups, or segmenting client lists for marketing campaigns can be automated. That means more time selling, less time on admin.

6. Smart integrations

The best CRMs connect seamlessly with the tools you already use, like email platforms, quoting software, policy management systems, and communication apps—so your workflow stays smooth and connected across every touchpoint.

Best CRM for insurance agents: What to look for

Not all CRMs are created equal. When choosing the best CRM for insurance agents, look for features tailored to your industry. Here’s what you should prioritise:

- Policy management tools to track active policies and renewal dates

- Automation for email, follow-ups, and task assignments

- Integration with quoting tools, email, and calendar apps

- Analytics and reporting for performance monitoring

- Mobile access, so agents can work on the go

Our CRM platforms that are perfect for insurance providers

If you’re still managing clients through spreadsheets or generic tools, it’s time to make the switch. A purpose-built insurance CRM solution doesn’t just make your work easier, it helps you serve your clients better, stay compliant, and grow your book of business.

Need help finding the best CRM for you? Book a free consultation with enable.services and let’s talk about your business requirements.